Despite most Chinese people’s lactose intolerance, China’s yogurt market is set to increase in the coming years. Yogurt is more attractive to Chinese consumers than any other milk product. This is because 90% of Chinese people have allergic reactions to dairy products, and yogurt breaks down a large portion of lactose during fermentation. As the demand for healthier choices continues to rise, the yogurt industry is undergoing significant innovation and transformation.

Download our China F&B White Paper

China’s yogurt market produces the most revenue worldwide

Revenue in China’s yogurt market has reached RMB 199.8 billion (USD 27.44 billion) as of July 2025. The market is expected to grow annually by 6.98% (CAGR 2025-2030). Globally, China has generated the most yogurt market revenue and stands as an industry leader in 2025. Meanwhile, the second global yogurt market, which is Europe, is growing at a 5.30% CAGR from 2025-2033. According to the National Food Safety Standard for Fermented Milk, yogurt is divided into four categories: sour milk, flavored sour milk, fermented milk, and flavored fermented milk. Only products made with raw cow’s/sheep’s milk or milk powder are considered yogurt products.

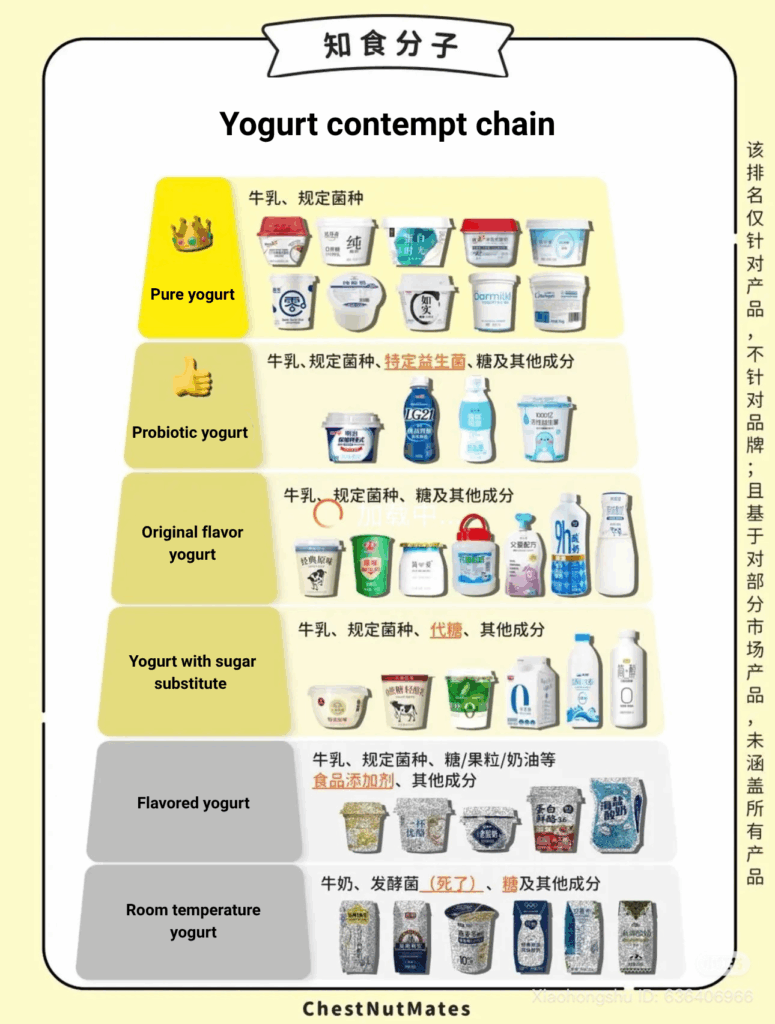

Within the Chinese yogurt market, there are two distinct varieties to consider, according to their storage temperatures. Low-temperature yogurt, favored for its superior taste and nutrition. However, it comes with a shorter shelf life and demands specialized logistics, including cold chain technology for transportation to the retail destination.

In contrast, room-temperature yogurt boasts a longer shelf life but is often perceived as nutritionally inferior. Historically, room-temperature yogurt prevailed due to limited refrigeration in retail channels. However, with rapid economic development, cold yogurt has gained popularity, valued by consumers for its taste and nutritional benefits.

Low- and room-temperature yogurts: different growth prospects

Room-temperature yogurt largely dominates the market, boasting nearly double the transaction volume of its low-temperature counterpart in 2021. Nevertheless, while the former experienced a growth rate of 6.1% from 2016 to 2021, this growth is anticipated to slow down to 3.6% between 2021 and 2026. From a traditional Chinese dietary perspective, low-temperature yogurt is not considered suitable for the two core dairy consumer groups, which are children and the elderly. According to traditional Chinese medicine, yogurt is a cold food that’s believed to harm the spleen and stomach, as children and the elderly are seen as having a weaker digestive system. Despite this, low-temperature yogurt has exhibited a remarkable growth rate of 14.3% and is projected to maintain a steady growth of 11.4% in the forecasted period from 2021 to 2026, thus narrowing the gap between the two varieties.

Health consciousness becomes the primary concern and driver of the market

As Chinese people increasingly prioritize healthy lifestyles, they prefer low-fat, additive-free options with little to no sugar and with high protein content. Yogurts are seen as nutritious drinks that provide probiotics and vitamins. The government is also actively encouraging the consumption of milk and yogurt, as evidenced in their “Healthy China Initiative (2019–2030)”, a guideline whose purpose is to prevent diseases and promote a healthy lifestyle for all citizens.

The habit of eating yogurt has been partially influenced by the West, as people post photos of their yogurt bowls online on platforms like Xiaohongshu. The main health benefits of yogurt are that it contains probiotics, which strengthen the immune system and make it a health ally against stomach problems. The aesthetics of the yogurt bowl contribute to the product’s popularity, as the hashtag #酸奶碗 (#Yogurtbowl) has gained more than 1.7 billion views and 5.1 million likes as of July 2025.

Chinese yogurt brands dominate the market

Domestic brands dominate the yogurt market in China as they are able to tailor products to local tastes and dietary habits, such as offering flavors like red date, grain blends, and aloe vera. According to the ranking site, Paizi Wang (牌子网), the best-ranking brands in the market for quality and price are: Yili’s Ambrosial (安慕希), specializing in Greek yogurt, Junlebao (君乐宝), Yili (伊利), Mengniu’s Chunzhen (纯甄), and Guangming’s Moslian (莫斯利安).

The only foreign brand that made it to the top 10 is the Japanese brand Yakult (养乐多), ranking at 8th place. Foreign brands are rare in the yogurt market as there are many challenges and barriers to entry, such as compliance costs, sourcing raw milk, and investment. It’s harder for foreign brands to scale in China due to slower localization, difficulty gaining consumer trust, and unfamiliarity with local Chinese demand and taste. Domestic companies are more aligned with government regulations, have strong networks with distribution centers, and are often innovating new yogurt products that resonate with domestic consumers’ health standards.

How yogurt is consumed in China

For Chinese consumers, yogurt has evolved into a product that can be sold in different formats. For instance, milk tea, bottled, or bowls that allow the consumer to eat on the go. Among the main occasions of yogurt consumption, 19% is consumed during breakfast, 16% is at home, usually after dinner, and 9% is in the office or school as a snack. Companies are taking advantage of this and developing new consumption scenarios for yogurts.

Simple Love: the brand that revitalized the low-temperature yogurt segment

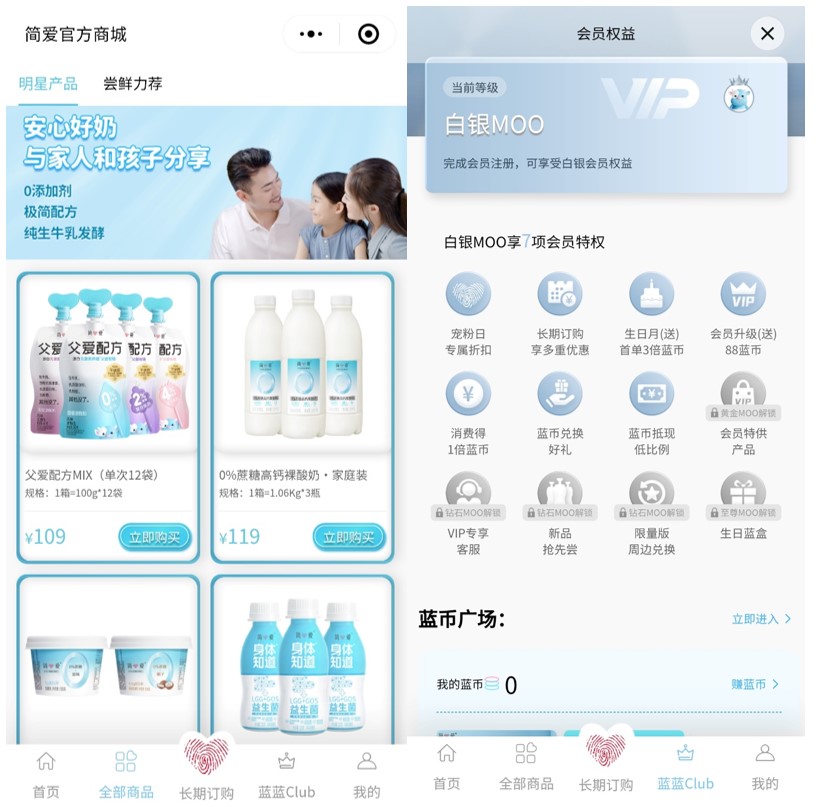

Simple Love (简爱) is a high-end brand established in June 2016 under the Pucheng Diary Group (朴诚乳业). It is renowned for its zero-additive low-temperature yogurts. The company boasts a high commitment to R&D; in fact, it uses machines imported from France, Italy, and Denmark.

Within 5 years, the brand grew by over 160%, ranking among the top brands in the sector. The founder, Xia Haitong, stated that between 2018 and 2020, Simple Love’s sales surged sixfold. It grew from RMB 300 million to an impressive RMB 2 billion. After which, the annual sales surpassed RMB 3 billion. Its unexpected popularity can be attributed to the fact that prior to them, the low-temperature yogurt market had been more or less overseen. Simple Love brought new life to the segment with its best-selling products “父爱配方” (The Love of a Father Formula) and “身体知道” (The Body Knows).

Instead of the usual offline retail channels, Simple Love uses new retail channels that integrate online and offline platforms. It can be found in Hema, Wal-Mart, Lawson, FamilyMart, 7-Eleven, as well as on e-commerce platforms, specifically JD, Tmall, and WeChat.

From room-to-low-temperature and now freshly made yogurt

While low-temperature yogurt started challenging the room-temperature counterpart’s predominance in the market, another competitor emerged. Freshly made yogurt started gaining popularity around 2020, when the trend of freshly brewed milk tea drinks subsided, and people started looking for something more refreshing and nutritious. It is then that already-existing offline stores gained momentum and won a name for themselves.

Blueglass, “the Hermès of yogurt”

Founded in 2012, Blueglass is an offline high-end yogurt store, specializing in low-temperature freshly made yogurts. It is particularly renowned for its collagen yogurt formula, which is said to help beautify the skin. To ensure the quality of its offerings, the brand meticulously manages its entire production process, from sourcing milk through its 10,000 Holstein cows to importing fresh, high-quality ingredients from overseas. Blueglass adheres to the brand concept of “craftsmanship, responsibility, sharing, and change”. With the high unit price (around RMB 40) and the commitment to producing excellence, it has earned the title of “the Hermès of yogurt”. It has also become trendy online as consumers review the many benefits and flavors offered by the brands.

More Yogurt is in rapid expansion

More Yogurt (茉酸奶) was first established in Shanghai in 2014. Ever since, it has opened more than 1,000 shops nationwide, mainly selling products following the formula “yogurt + fresh fruit + nut toppings”. It is located in the mid-to-high-end, with the price range varying between RMB 20 to 35.

The brand recently started a process of store expansion. The number of stores has already tripled within half a year. More Yogurt already has more than 1,600 offline stores throughout China as of 2023 and plans on continuing expansion.

Oarmilk’s expansion in the chilled yogurt market

Oarmilk is a Beijing-based brand that has stood out in grocery stores for its high protein positioning. It targets middle-class families who are health-conscious. The company reported RMB 500 million (USD 69.7 million) in revenue for 2024. Moreover, it is leading the domestic low-temperature Greek yogurt market in China. As the low-temperature yogurt market is showing signs of revival, Oarmilk is continuing expansion into this niche. s it invested heavily in health-centric innovations.

China’s thriving yogurt market: trends, brands, and challenges

- China’s yogurt market has reached RMB 199.8 billion as of July 2025. The market is expected to grow annually by 6.98% from 2025 to 2030.

- Chinese yogurt comes in two main varieties based on storage temperature. Low-temperature yogurt, favored for its taste and nutrition, but with a shorter shelf life. Room-temperature yogurt, which has a longer shelf life but is seen as less nutritious.

- Health consciousness is driving consumption of yogurt in China, with a preference for low-fat, additive-free, low-sugar, high-protein options.

- Major Chinese yogurt brands include Yili’s Ambrosial, Junlebao, Yili, Mengniu’s Chunzhen, and Guangming’s Moslian.

- Blueglass and More Yogurt are the most prominent retail stores for high-end yogurt on the go in China.